Understanding UPI’s DNA

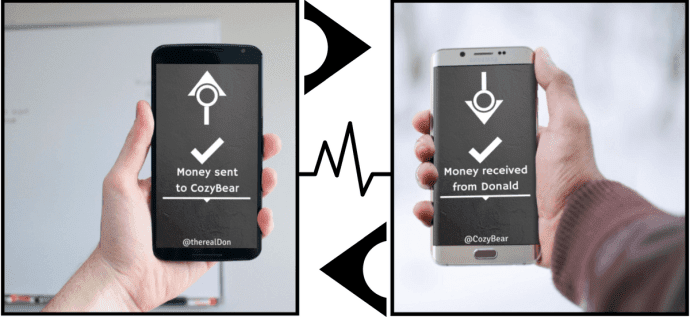

To put it in the simplest terms – UPI is a payment system that allows money transfer between any two bank accounts using a smartphone. Think of it like a unique email ID for payments, which is secure and free to use. What’s more, you don’t need to remember IFSC codes or even account numbers to accomplish money transfer using UPI. A user can simply use a UPI-enabled app to transfer any amount using his contacts list. Just like sending a message on WhatsApp. UPI will eliminate the need to add beneficiaries to your online banking account as you only need a unique virtual payment address. This virtual address will look something like [email protected] (if you’re using Yes Bank, for example). Participating banks have already started making their own apps for UPI.

Better than e-Wallets

So how does this differ exactly from e-wallets? For starters, you have to keep adding money to your e-wallet from your linked bank account. And this part itself is not very convenient. Moreover in the case of a non-KYC case, the transaction is limited to Rs. 10,000 only. Also, e-wallets are used only in some places. Hence, you may no longer need an e-wallet if convenience is your primary focus for using the product. Also, you will be able to use multiple e-wallets seamlessly as they will become inter-operable with UPI.

Flipkart’s Move

When Flipkart bought PhonePe, they had the idea of building India’s first UPI based app. PhonePe itself was co-founded by ex-Flipkart employees Sameer Nigam and Rahul Chari. And since UPI has now been announced, Flipkart has wasted no time in launching their Android app. PhonePe seems to be a very simple to use app, where you simply register your mobile number and email ID once and create a unique 4-digit mPIN. This mPIN is the only number that you then need to remember as transactions will then be seamlessly linked with your bank account. Not all banks have participated in UPI yet, but there is a ‘Notify Me’ option which will alert you once your bank is on board.

The Future is Here

UPI was a bold move to eliminate the need for cash and move into a cashless economy. The obvious benefit is to cut down on black money and make P2P transfers super simple. ALSO READ: How to Easily and Securely Send Money with Square Cash The above article may contain affiliate links which help support Guiding Tech. However, it does not affect our editorial integrity. The content remains unbiased and authentic.